|

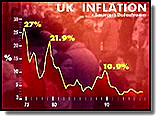

Inflation Hits New HighThe Government has insisted its economic policy is still on track despite inflation hit its highest level for two years.The headline annual inflation rate rose to 3.3% in July from 2.9% in the previous month, driven up by petrol duty rises in the Budget and higher mortgage costs following the interest rate rises. The Government's preferred measure, which excludes mortgage costs, rose to 3.0% from 2.7% in June, according to the Office for National Statistics. The rise means the Government has missed its target of 2.5% for its preferred rate for the second successive month since the general election. The headline rate is now at its highest level since September, 1995, when it was 3.9%.

Despite the rise, the Treasury Minister Geoffrey Robinson said he believed the Government would be broadly back on course for its 2.5% inflation target in the next couple of months. The Government "took certain measures in the Budget on consumption, and the Bank of England has had to take measures on interest rates because the previous Government didn't face up to the inflationary pressures that were emerging. "But (with) the steps that we've now taken ... if the Budget numbers work through, and we get some of the benefits from the Budget as well on the disinflationary side, we can look forward to it being on target within the next couple of months," he stressed. Mr Robinson denied there would need to be further interest rate rises to meet the 2.5% inflation target.

The Tory industry spokesman Michael Fallon attacked Labour over the new figures. "The rise in the inflation rate is the direct result of Gordon Brown's botched Budget," he said. "Labour's decision to jack up taxes, starting with a higher than expected rise in petrol duty, has fed straight through into higher prices and higher inflation," he added. "No wonder the Bank of England raised interest rates again last week." His comments were echoed by the Liberal Democrat Treasury spokesman Malcolm Bruce. "The inflation news is very disappointing, especially as the big rise in the pound should have been helping to keep prices down," he said. But analysts said the rise should not have a major influence on interest rates, following the Bank's statement last week that the current levels of rates were "consistent" with the inflation target. HSBC's Roger Bootle said the Bank would look at the figure stripping out mortgage interest payments and indirect taxes. "Look at the underlying picture - that shows a picture that is quite encouraging with inflation hardly moving at all," he said.

|

Diana, Princess of Wales, 1961-1997

Conference 97

Devolution

The Archive

News |

Issues |

Background |

Parties |

Analysis |

TV/Radio/Web

Interactive |

Forum |

Live |

About This Site

News |

Issues |

Background |

Parties |

Analysis |

TV/Radio/Web

Interactive |

Forum |

Live |

About This Site

© BBC 1997 |

politics97@bbc.co.uk |