|

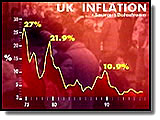

Government Could Miss Inflation TargetThe Bank of England says that there is still a risk the government could miss its inflation target in two years' time - despite the four recent interest rate rises.In its authoritative Quarterly Inflation Report, the Bank said its central forecast was that the target of 2.5% would be achieved, but added that the risks were "on the up side". However, interest rates are likely to remain on hold for the time being as the Bank said it was time to "take a pause to assess the risks". The central forecast is lower than that given in the May quarterly report. The Bank now sees the outlook for inflation as "favourable". It said economic growth was likely to fall back later this year and in 1998 as the strong pound and the measures taken in the Budget would begin to bite, while the flood of building society conversion windfalls would dry up.

However the Bank does not predict a recession. Its economists believe that output will pick up again in about two years' time.

Monetary Policy Committee Unanimous on Rate RiseLast week the Bank's new Monetary Policy Committee had raised rates by 0.25% for the fourth time in as many months, but added that they were now "consistent" with the inflation target.The minutes of the committee's meeting have now been published, and show that the six members debated whether rates should be raised by 0.25% or 0.5%, before opting for the lower rate.

|

Diana, Princess of Wales, 1961-1997

Conference 97

Devolution

The Archive

News |

Issues |

Background |

Parties |

Analysis |

TV/Radio/Web

Interactive |

Forum |

Live |

About This Site

News |

Issues |

Background |

Parties |

Analysis |

TV/Radio/Web

Interactive |

Forum |

Live |

About This Site

© BBC 1997 |

politics97@bbc.co.uk |